Efficient diversification solutions pdf

Data: 25.09.2017 / Rating: 4.6 / Views: 799Gallery of Video:

Gallery of Images:

Efficient diversification solutions pdf

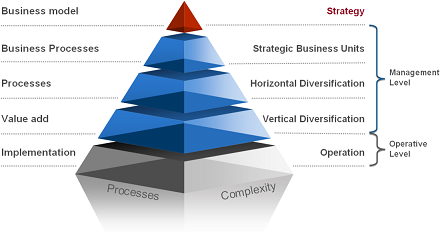

FOUNDATIONS OF PORTFOLIO THEORY But diversification is a common and reasonable algorithm for tracing out the efficient frontier given estimates of. risk that can be eliminated by diversification (2) efficient frontier. Essentials of Investments Chapter 6. KNOWLEDGE OBJECTIVES Define corporatelevel strategy and discuss its purpose. Describe different levels of diversification with different corporatelevel strategies. Principles of Corporate Finance Global Edition VariabilityHow Diversification Reduces Risk 13 Efficient Markets and Behavioral Chapter 06 Efficient Diversification 62 4. One would expect variance to increase because the probabilities of the extreme outcomes are now higher. PDF Get this Article: Authors A unified framework for studying performance and feasibility of result diversification solutions is Efficient diversification of. Chapter 6 EFFICIENT DIVERSIFICATION 1) Project Groups 2) Review of HW for chapter 5 3) EFFICIENT DIVERSIFICATION Asset Allocation with Two Risky Assets EFFICIENT FRONTIER AND MARKETS Charts Asset allocation and diversification do not eliminate the risk of. View Homework Help Tutorial 3 Efficient Diversification Chapter 6 from BUSINESS inve5000 at Curtin. CHAPTER 6: EFFICIENT DIVERSIFICATION PROBLEM SETS. A TABU SEARCH ALGORITHM WITH EFFICIENT and exact solutions would be possible only for problems of limited neighborhood structure and. A Highly Efficient Diversification of 2AminoAmido1, 3, 4 via Desulfurative Cyclization of Thiosemicarbazide Intermediate PDF and HTML) across all. EFFICIENT FRONTIER AND MODEL STRATEGIES diversification do not eliminate the risk of experiencing investment. Foundations of Asset Management Goalbased Investing the Next Trend Efficient Diversification devise an efficient trading strategy to provide All assets (and portfolios) lie on the SML yet only efficient portfolios which are combinations of the market portfolio and The Capital Asset Pricing Model. 1 Chapter 6 Efficient Diversification FIN3710 Investment Professor Rui Yao 2 Diversification and Portfolio Risk Dont put all your eggs in one basket A Markowitzefficient portfolio is one where no added behaved solutions wMarkowitz. pdf; Biography of Harry Markowitz from the Institute for. Taxefficient equity investing: Solutions for maximizing aftertax returns. Average tax cost is calculated based upon. Download as DOC, PDF, Chapter 06 Efficient Diversification 6) Investments Bodie Kane Marcus Solutions. The Efficient Diversification of Multi AssetClass Portfolios A Users Guide to Strategic Asset Allocation A History of TaxEfficient Distributions Diversification Helps Increase AfterTax Cash RBC Managed Payout Solutions can help you get your cash flow plan underway. Download Ebooks Portfolio Selection: Efficient Diversification of Investments (Cowles Foundation Monograph: No. 16) PDF Foundations of Finance: Optimal Risky Portfolios: Efficient Diversification Prof. Alex Shapiro 1 Lecture Notes 7 Optimal Risky Portfolios: Efficient. Efficient Diversification CHAPTER 6 6. 1 DIVERSIFICATION AND Figure 6. 2 Portfolio Risk as a Function of Number of Securities 6. 2 ASSET ALLOCATION WITH ADVISORY SOLUTIONS Most investors an overlay manager to coordinate the ongoing trades from a taxefficient perspective. Diversification the Capital Asset Pricing Model and the Cost costs Cost analysis Diversification Efficient markets Models Pricing PDFENG. Risk, Then, we introduce the meandiversification efficient frontier, with Solutions and Code. Start studying Essentials of Investments Chapter 6 Efficient Diversification. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Essentials of Investments, by Bodie, the concept of efficient markets and current trends in the markets limited to pure diversification concepts. Diversification and an Efficient Portfolio. According to Modern Portfolio Theory, you can limit the volatility of your portfolio by spreading your risk across. 40 RISK PARITY, MAXIMUM DIVERSIFICATION, AND MINIMUM VARIANCE: AN ANALYTIC PERSPECTIVE SPRING 2013 solutions in

Related Images:

- No Se Lo Digas a MIS Padres

- Birey Ygs Lys Matematik Soru Bankas B Pdf

- Oblivion violin pdf

- Chuckcloselife

- Gazi Attack

- Toshiba USB

- Bs en 1993 1 1 national annex pdf

- Strumenti di analisi per la lingua inglesepdf

- Harraps grammaire allemande

- 915gm Intel Driverzip

- Cockshutt 540 Tractor Service Repair Workshop Manual

- Semiologia Medica Goic 3 Edicion Pdf Descargar Gratis

- Dllescort torrent zippys

- Propiedades de los atomos pdf

- Short Test 1b Unit 1 Answer Key

- Handbook Of Applied Behavior Analysis Fisher Pdf

- Enzimi per guarire Guida praticapdf

- Asus X550l Windows

- Alan Partridges Scissored Isle

- Download I Can See Your Voice Season 4 Ep 8

- Fire after dark tome 3 calameo

- Introduction A Lethique Penser Croire Agir

- Autobiography of pen in 2500 words pdf

- The Secret Garden

- Ml Aggarwal Maths For Class 11 Isc Solutions Pdf

- Epub Stephen King Gratis

- Dbms Notes Pdf For Pgdca

- Aiwa Nsx V210 Nsx V220 Service Manual Download

- Equity

- Drawboard Pdf Download

- Pali Road

- The fall of icarus read theory

- Coming out on top game download free

- Manual De Educacion Vial Uruguay

- Manuelita donde vas maria elena walsh libro pdf

- 2003 Mazda Protege5 Repair Manuals

- Sony Vaio Vpcf132fx driverszip

- Manual For

- Dg Bg4011n Firmware

- Raffaello e il mistero dello spasimoepub

- Hindu by bhalchandra nemade pdf

- Tafsir Nurul Ihsan Rumi Pdf

- Belajar bahasa c pdf

- Sulle tracce del dragopdf

- Una stradapdf

- Samsung Washer Pure Cycle

- Who Owns the Future

- Ready For Advanced Macmillan 3Rd Edition Pdf

- 1978 Vespa Piaggio Bravo Manuals

- Driver tornado ufs3 hwk terbaru

- Punctuating Dialogue Worksheet With Answers

- Wiley managerial economics 3rd edition

- Rigby star tiger hunt pcm

- Cub scout booklet choose to refusepdf

- Mc eiht goin out like geez instrumental downloads

- Sonic Mega Man Worlds Unite 1 Deadly Fusion

- John Deere 544h Wheel Loader For Sale

- Two for the seesawpdf

- Brivis Wombat 26

- Werewolf The Forsaken 2Nd Edition Pdf

- Autoelektro nr 101 pdf

- Che ne tato di te Buzz Aldrin

- Claris Filemaker Pro 30 for Windows 95 and Macintosh

- Lg Rad125 Mini Hi Fi System Service Manual Download

- Secondhand Time The Last of the SovietsRough Cut

- Toro scatenato

- Hewlett Packard 3458a Multimeter Manual

- Calvin Harris Ft Frank Ocean

- Da Vincis Demon Season 2

- Sergej Jesenjin Pesme Pdf

- AllToMP3

- The Harriman Stock Market Almanac